2Nd Credit Counseling Course Answers

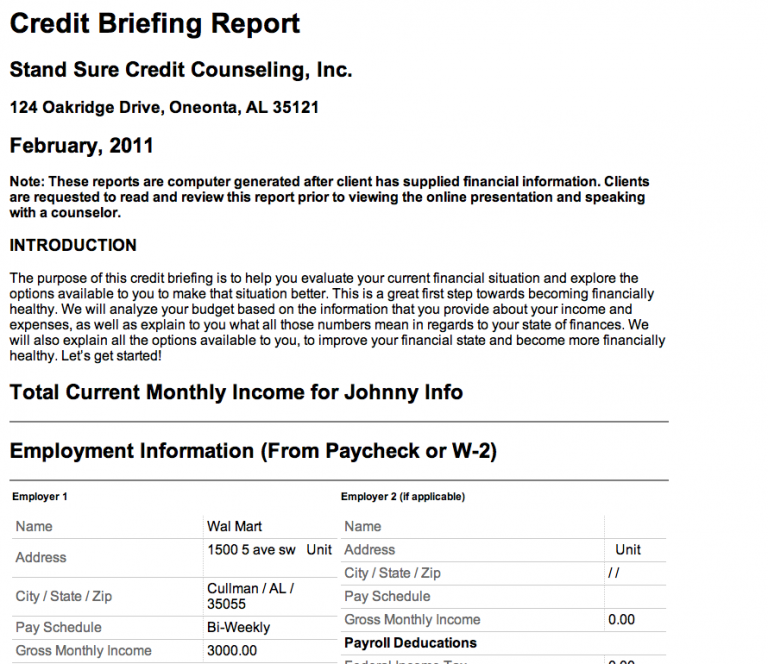

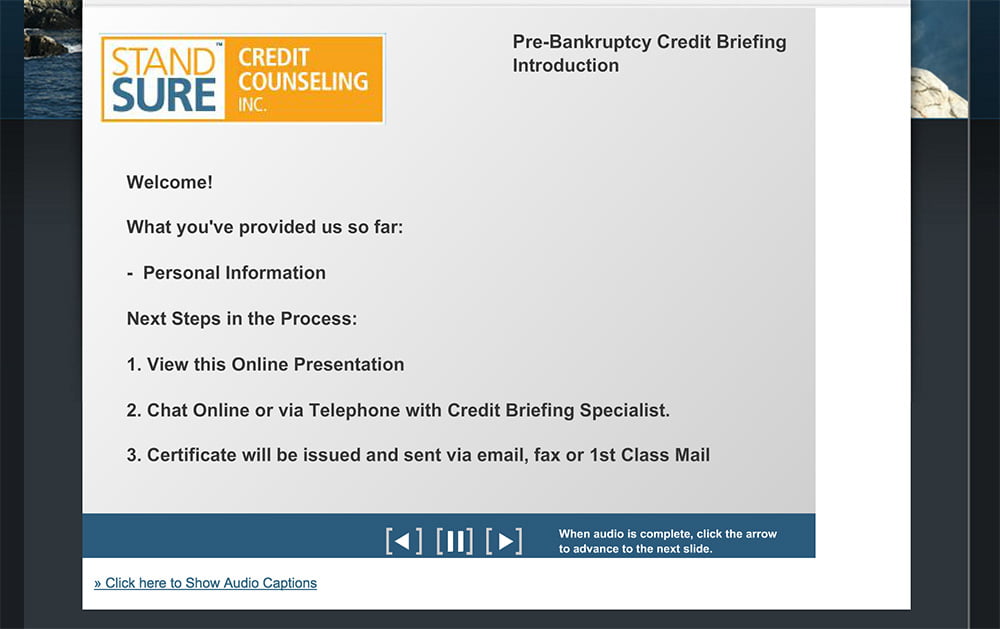

2Nd Credit Counseling Course Answers - Required courses before and after bankruptcy | peter francis geraci law l.l.c. Trusted loan guidancesimple & smart formmake smart money choices First course and second course bankruptcy classes before & after you file for bankruptcy. The financial strategies you learn will. Every individual seeking bankruptcy relief must complete two educational courses: The cost of the credit. A) true b) false question 10 0 / 5 points a debtor must complete a financial management course after. Every person that files for bankruptcy is required to complete two credit counseling courses. Individuals filing for bankruptcy must complete both the credit counseling course and the debtor education course. The course cannot be completed any. The purpose of debtor education is to provide you with the knowledge and skills to take control of your financial future. First course and second course bankruptcy classes before & after you file for bankruptcy. Required courses before and after bankruptcy | peter francis geraci law l.l.c. The course is taken after your bankruptcy has been filed but before you receive your discharge. A) true b) false question 10 0 / 5 points a debtor must complete a financial management course after. Every person that files for bankruptcy is required to complete two credit counseling courses. Bankruptcy credit counseling, debtor education (personal financial management) courses. The course cannot be completed any. The second course is required as part of your bankruptcy. The second course is called the debtor education course or the. The second course is called the debtor education course or the. Free credit counselingdebt management plansonline credit counselingavailable 24/7 Free credit counselingdebt management plansonline credit counselingavailable 24/7 The cost of the credit. Trusted loan guidancesimple & smart formmake smart money choices The credit counseling course must be completed before filing, and the. Every individual seeking bankruptcy relief must complete two educational courses: Study with quizlet and memorize flashcards containing terms like bankruptcy, leading causes of bankruptcy, causes of business bankruptcy and more. Free credit counselingdebt management plansonline credit counselingavailable 24/7 Required courses before and after bankruptcy | peter francis geraci law. The purpose of debtor education is to provide you with the knowledge and skills to take control of your financial future. Expert debt reliefin business since '98shop with confidence A debtor must take a credit counseling course prior to filing a bankruptcy petition. Which course do i need to take? Get information about bankruptcy credit counseling and debtor education courses. The purpose of debtor education is to provide you with the knowledge and skills to take control of your financial future. A) true b) false question 10 0 / 5 points a debtor must complete a financial management course after. Counseling must occur within 180 days prior to filing a chapter 7. Get information about bankruptcy credit counseling and debtor. Every person that files for bankruptcy is required to complete two credit counseling courses. Free credit counselingdebt management plansonline credit counselingavailable 24/7 Required courses before and after bankruptcy | peter francis geraci law l.l.c. The cost of the credit. Every person that files for bankruptcy is required to complete two credit counseling courses. A debtor must take a credit counseling course prior to filing a bankruptcy petition. Every individual seeking bankruptcy relief must complete two educational courses: Study with quizlet and memorize flashcards containing terms like bankruptcy, leading causes of bankruptcy, causes of business bankruptcy and more. The cost of the credit. Before you file for bankruptcy you need to take a credit. The cost of the credit counseling courses is $50 or $25 for each session. Once you complete the course you will receive a certificate that. Trusted loan guidancesimple & smart formmake smart money choices Bankruptcy credit counseling, debtor education (personal financial management) courses. As part of the bankruptcy process, you must complete credit counseling with a certified credit counseling agency. The bankruptcy credit counseling course must be completed 180 days before you file your bankruptcy petition. First course and second course bankruptcy classes before & after you file for bankruptcy. Every person that files for bankruptcy is required to complete two credit counseling courses. The credit counseling course is completed before the bankruptcy petition is filed with the court. Free. The purpose of debtor education is to provide you with the knowledge and skills to take control of your financial future. Expert debt reliefin business since '98shop with confidence Every person that files for bankruptcy is required to complete two credit counseling courses. The credit counseling course is completed before the bankruptcy petition is filed with the court. Per the. The credit counseling course must be completed before filing, and the. Once you complete the course you will receive a certificate that. Every person that files for bankruptcy is required to complete two credit counseling courses. First course and second course bankruptcy classes before & after you file for bankruptcy. Expert debt reliefin business since '98shop with confidence The purpose of debtor education is to provide you with the knowledge and skills to take control of your financial future. Per the code, you have 45 days after the first scheduled date for the §341 meeting of creditors to complete the debtor education course. Trusted loan guidancesimple & smart formmake smart money choices The financial strategies you learn will. The credit counseling course must be completed before filing, and the. The course cannot be completed any. The second course is required as part of your bankruptcy. Free credit counselingdebt management plansonline credit counselingavailable 24/7 Which course do i need to take? Before you file for bankruptcy you need to take a credit counseling course that has been approved for illinois bankruptcy filers. The course is taken after your bankruptcy has been filed but before you receive your discharge. Once you complete the course you will receive a certificate that. Bankruptcy credit counseling, debtor education (personal financial management) courses. The credit counseling course is completed before the bankruptcy petition is filed with the court. My answers to any avvo question are rooted in general legal principles, and not specific state laws. The second course is called the debtor education course or the.How Credit Counseling Works Course) Stand Sure Counseling

How Credit Counseling Affects Your Credit Score YouTube

Credit Counseling Courses Arizona Zero Down Bankruptcy

Credit Counseling 101 FinMasters

How Credit Counseling Works Course) Stand Sure Counseling

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

Credit Counseling National Foundation for Credit Counseling

How Does the Credit Counseling Course Work?

PPT Credit Counseling & Financial Management PowerPoint Presentation

4/27/25 Sunday Worship with Bethany Christian Church (DOC) Cleveland

Every Person That Files For Bankruptcy Is Required To Complete Two Credit Counseling Courses.

The Cost Of The Credit.

The Cost Of The Credit Counseling Courses Is $50 Or $25 For Each Session.

Our Mission Is To Provide Quality Credit And Financial Education From Compassionate, Certified Credit Counselors To Consumers Who Are Ready To Take The Next Steps To Financial Freedom.

Related Post: