Annual Filing Season Program Courses

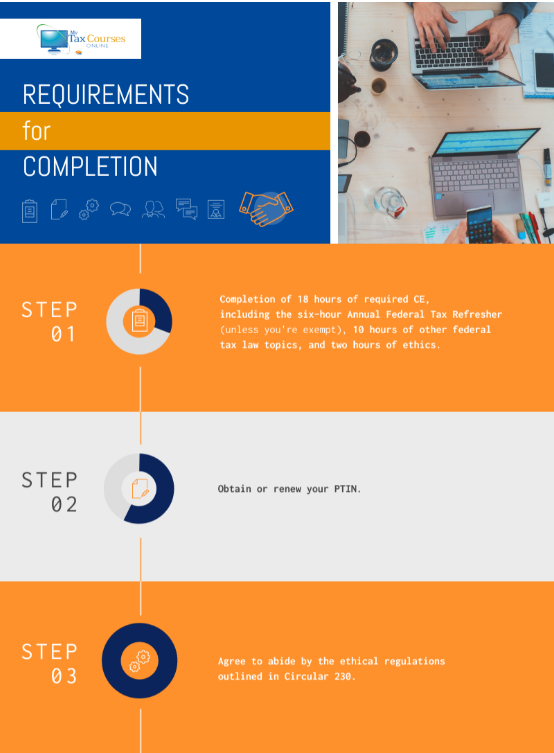

Annual Filing Season Program Courses - Stay compliant and updated with tax knowledge. The irs annual filing season. Unlock the benefits of the irs annual filing season program with our comprehensive guide on eligibility, education, and certification steps. Complete the necessary credits and become an afsp tax preparer. The irs has introduced a new accreditation program targeting tax preparers who are not enrolled agents, cpas, or attorneys. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need to know to pass the aftr exam and. Meet the 2024 annual filing season program requirements with the irs aftr course. This new designation is titled irs annual filing season program. The annual filing season program is intended to recognize and encourage unenrolled tax return preparers who voluntarily increase their knowledge and improve their. The annual filing season program is intended to recognize and encourage unenrolled tax return preparers who voluntarily increase their knowledge and improve their. Unlock the benefits of the irs annual filing season program with our comprehensive guide on eligibility, education, and certification steps. Click here to learn more about how you can be part of the irs annual filing season program (afsp). Stay compliant and updated with tax knowledge. The irs annual filing season. What is the annual filing season program for return preparers? The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need to know to pass the aftr exam and. By participating in the program you will receive a record a completion, be placed on. Meet the 2024 annual filing season program requirements with the irs aftr course. Unlock the benefits of the irs annual filing season program with our comprehensive guide on eligibility, education, and certification steps. Meet the 2024 annual filing season program requirements with the irs aftr course. This new designation is titled irs annual filing season program. The annual filing season program is intended to recognize and encourage unenrolled tax return preparers who voluntarily. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. Complete the necessary credits and become an afsp tax preparer. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. Join the irs annual filing season program. Meet the 2024 annual filing season program requirements with the irs aftr course. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you. Complete the necessary credits and become an afsp tax preparer. The irs annual filing season. Click here to learn more about how you can be part of the irs annual filing season program (afsp). Join the irs annual filing season program and enhance your skills with our federal tax refresher course. The illinois (il) cpe course list from surgent contains. Complete the necessary credits and become an afsp tax preparer. The irs has introduced a new accreditation program targeting tax preparers who are not enrolled agents, cpas, or attorneys. Meet the 2024 annual filing season program requirements with the irs aftr course. The irs annual filing season program is a voluntary program designed to highlight tax preparers who have demonstrated. The irs annual filing season program is a voluntary program designed to highlight tax preparers who have demonstrated a willingness to improve their tax knowledge and filing competency. This new designation is titled irs annual filing season program. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need. Stay compliant and updated with tax knowledge. This new designation is titled irs annual filing season program. Complete the necessary credits and become an afsp tax preparer. Whether through our annual fall tax school in november and december or webinars and seminars throughout the year, we provide the information you want and the cpe you need. The irs annual filing. Stay compliant and updated with tax knowledge. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need to know to pass the aftr exam and. What is the annual filing season program for return preparers? Click here to learn more about how you can be part of the. Whether through our annual fall tax school in november and december or webinars and seminars throughout the year, we provide the information you want and the cpe you need. The irs annual filing season. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need to know to pass. The irs annual filing season. This new designation is titled irs annual filing season program. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need to know to pass the aftr exam and. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe). Join the irs annual filing season program and enhance your skills with our federal tax refresher course. This new designation is titled irs annual filing season program. What is the annual filing season program for return preparers? Meet the 2024 annual filing season program requirements with the irs aftr course. Learn how to join the irs annual filing season program, including eligibility, education requirements, and enrollment steps for tax preparers. The irs has introduced a new accreditation program targeting tax preparers who are not enrolled agents, cpas, or attorneys. During our live and interactive annual federal tax refresher (aftr) workshops, your instructor will highlight the changes and complex topics you need to know to pass the aftr exam and. Complete the necessary credits and become an afsp tax preparer. The illinois (il) cpe course list from surgent contains thousands of continuing professional education (cpe) options for public accountants and other finance professionals that include a. Stay compliant and updated with tax knowledge. The irs annual filing season program (afsp) is an annual voluntary irs training program for tax preparers. By participating in the program you will receive a record a completion, be placed on. Unlock the benefits of the irs annual filing season program with our comprehensive guide on eligibility, education, and certification steps. The irs annual filing season program is a voluntary program designed to highlight tax preparers who have demonstrated a willingness to improve their tax knowledge and filing competency.2019 Annual Filing Season Program Lopez EA MA, Kristeena S

Best Annual Filing Season Program Courses Reviewed & Rated Beat the

Everything you need to know about the Annual Filing Season Program

Irs Annual Filing Season Program 2024 Kala Salomi

IRS|Annual Filing Season Program (AFSP) Overview YouTube

Tax Pros Here’s How to participate in the IRS Annual Filing Season

2023 Annual Filing Season Program Laza

Annual Filing Season Program eBook Saber Tax Training

2024 Annual Filing Season Program (AFSP) TaxSensePro

Annual Filing Season Program tax slayer training

Click Here To Learn More About How You Can Be Part Of The Irs Annual Filing Season Program (Afsp).

The Annual Filing Season Program Is Intended To Recognize And Encourage Unenrolled Tax Return Preparers Who Voluntarily Increase Their Knowledge And Improve Their.

Whether Through Our Annual Fall Tax School In November And December Or Webinars And Seminars Throughout The Year, We Provide The Information You Want And The Cpe You Need.

The Irs Annual Filing Season.

Related Post: