Ea Tax Preparer Course

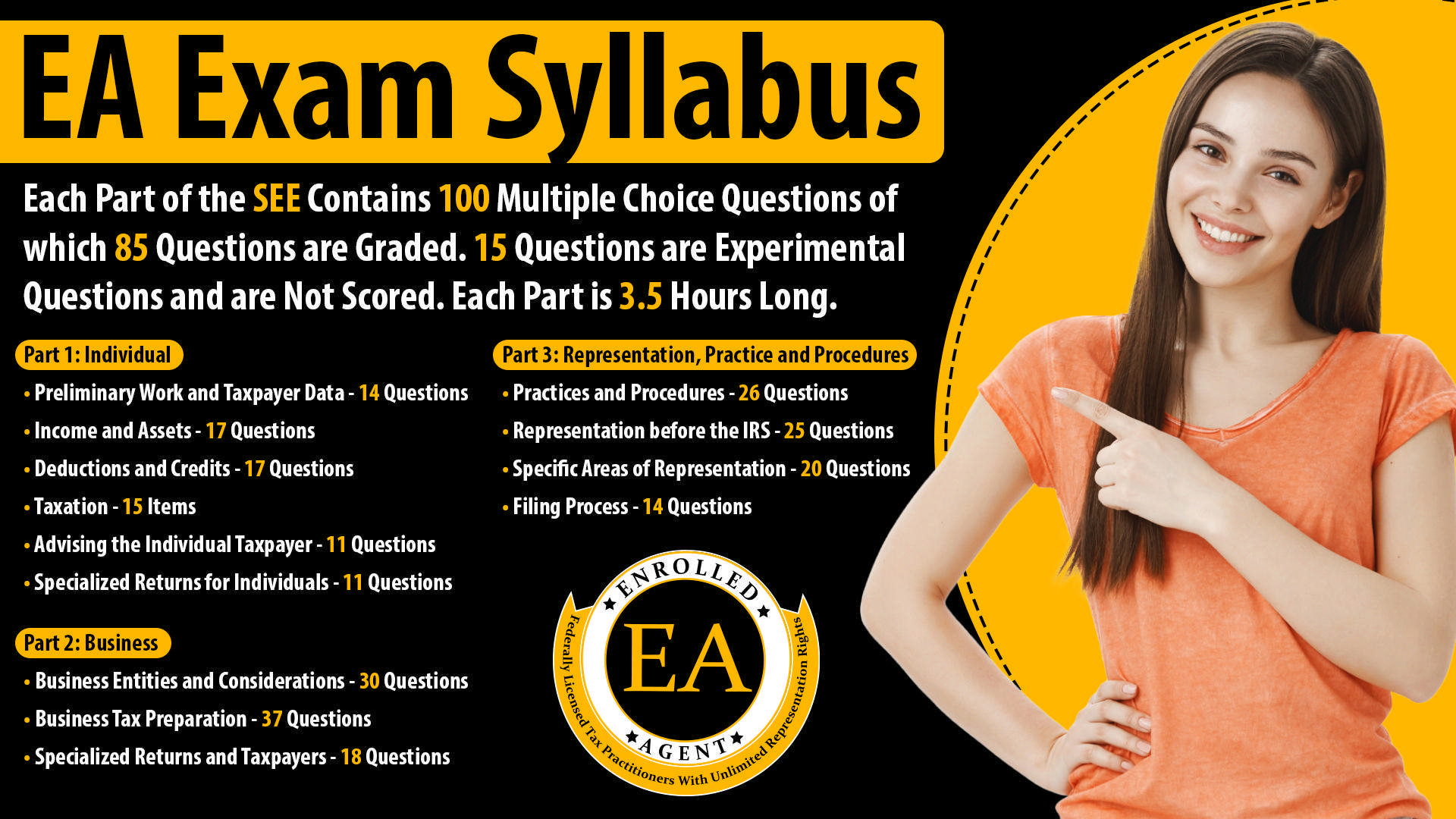

Ea Tax Preparer Course - A ptin is a unique identification. To become an ea, you must meet specific educational requirements, including obtaining a preparer tax identification number (ptin). Many aspiring eas pursue formal education or specialized training programs to prepare for this challenging exam. This exam, known as the special enrollment exam, or see, covers. The certification entitles you to provide. If you choose the enrolled agent route, you can expect. Becoming an enrolled agent (ea) is a fantastic way to build a successful career in tax preparation and representation. This is the fourth of 4 videos in the ea tax trai. An enrolled agent (ea) is a highly qualified tax professional who has earned the legal. Take the next step in your tax preparation career, and earn. Personalized contentaccurate & timely coursescredit hour variety A ptin is a unique identification. Pass the enrolled agent exam the first time. This is the fourth of 4 videos in the ea tax trai. Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs. Speed up your path to become an enrolled agent with three different plan options to help you succeed in passing the ea exam. This exam, known as the special enrollment exam, or see, covers. Presented by tom norton cpa, ea. It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. An enrolled agent (ea) is someone who has passed the enrolled agent exam and obtained an ea certification that identifies them as someone who is familiar enough with the tax code to. An enrolled agent (ea) is a highly qualified tax professional who has earned the legal. Ea exam prep course, part 3, 2025, filing process. As a tax professional, an ea has the authority to represent taxpayers. Many aspiring eas pursue formal education or specialized training programs to prepare for this challenging exam. What is an enrolled agent? Refreshers, plus corporation, partnership, and trust tax training, and major bonuses. This exam, known as the special enrollment exam, or see, covers. To become an ea, you must meet specific educational requirements, including obtaining a preparer tax identification number (ptin). If you choose the enrolled agent route, you can expect. The certification entitles you to provide. Free sample courseaccepted all 50 statesinstant accessirs approved Increase your income and learn how to become an enrolled agent with our irs approved ea exam review course. We’ve updated our entire ea video library with brand new gleim. Pass the enrolled agent exam the first time. Become an ea with gleim, the enrolled agent course tax preparers trust. It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs. Prepare for, take, and pass the ea exam. The prices below reflect a 20% discount off the regular list. If you choose. What is an enrolled agent? Free sample courseaccepted all 50 statesinstant accessirs approved An enrolled agent (ea) is a highly qualified tax professional who has earned the legal. It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. Speed up your path to become an enrolled agent with three different plan options. To become an ea, you must meet specific educational requirements, including obtaining a preparer tax identification number (ptin). It has everything you need to pass the enrolled agent exam, which is testable beginning may 1, 2025. What is an enrolled agent? We’ve updated our entire ea video library with brand new gleim. Take the next step in your tax preparation. Pass the enrolled agent exam the first time. Prepare for, take, and pass the ea exam. As a tax professional, an ea has the authority to represent taxpayers. Take the next step in your tax preparation career, and earn. The certification entitles you to provide. An enrolled agent (ea) is someone who has passed the enrolled agent exam and obtained an ea certification that identifies them as someone who is familiar enough with the tax code to. Pass the enrolled agent exam the first time. It can be challenging to choose the best ea review course or study guide that will enable you to pass. What is an enrolled agent? Become an ea with gleim, the enrolled agent course tax preparers trust. The certification entitles you to provide. A ptin is a unique identification. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. Increase your income and learn how to become an enrolled agent with our irs approved ea exam review course. What is an enrolled agent? The prices below reflect a 20% discount off the regular list. Become an ea with gleim, the enrolled agent course tax preparers trust. Take the next step in your tax preparation career, and earn. Pass the enrolled agent exam the first time. Many aspiring eas pursue formal education or specialized training programs to prepare for this challenging exam. What is an enrolled agent? The prices below reflect a 20% discount off the regular list. It can be challenging to choose the best ea review course or study guide that will enable you to pass the see exam and earn your enrolled agent certification as quickly as possible. The certification entitles you to provide. Take the next step in your tax preparation career, and earn. Become an ea with gleim, the enrolled agent course tax preparers trust. This is the fourth of 4 videos in the ea tax trai. Apply to become an enrolled agent, renew your status and irs preparer tax identification number (ptin) and learn about continuing education. Take your career to the next level by becoming an enrolled agent (ea), the highest credential awarded by the irs. Prepare for, take, and pass the ea exam. As a tax professional, an ea has the authority to represent taxpayers. Presented by tom norton cpa, ea. An enrolled agent (ea) is someone who has passed the enrolled agent exam and obtained an ea certification that identifies them as someone who is familiar enough with the tax code to. Speed up your path to become an enrolled agent with three different plan options to help you succeed in passing the ea exam.How to be an Enrolled AgentScope and Benefit for Tax Professionals

an Enrolled Agent with Universal Accounting Training

Tax Formula. CPA/EA Exam. Tax Course YouTube

Enrolled AgentUS Tax Expert iLead Tax Academy

US Tax Representative Enrolled Agent (EA) IRS Approved Courses

The Benefits of Enrolled Agent Certification for Tax Professionals

Tax & Accounting Training Manual Learn Tax Planning, Tax Resolution

Enrolled Agent Course (EA USA) Certification US tax Exam and Preparation

EA Vs. CPA US Course Who Should do which? Uplift professionals

Why should a tax professional do EA? HiEducare

Becoming An Enrolled Agent (Ea) Is A Fantastic Way To Build A Successful Career In Tax Preparation And Representation.

To Become An Ea, You Must Meet Specific Educational Requirements, Including Obtaining A Preparer Tax Identification Number (Ptin).

A Ptin Is A Unique Identification.

If You Choose The Enrolled Agent Route, You Can Expect.

Related Post: