Free Ethics Cpe Courses

Free Ethics Cpe Courses - Nasba approved aicpa 2 hours ethics course for cpas. Webinars & seminarscpe credits for eascpe credits for cpasunlimited cpe credits The course may offer 'full course, no certificate' instead. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. This webcast qualifies to satisfy the general professional ethics requirement in all states, except the following states which require state. Get your illinois cpa continuing education courses online at cpe think. This cpe ethics course is approved for cpas. Whether you’re looking to brush up on your tax knowledge, learn about the hot new. Discover a wide array of today’s hottest topics with practical takeaways, delivered in a way that fits your busy work schedule. Our ethics courses prepare you to make the most moral decisions by helping you gain perspective on the wide breadth of issues facing cpas. The course may offer 'full course, no certificate' instead. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public. Illinois cpa society cpe courses are an efficient learning solution to develop practical strategies to implement at your firm or company. This webcast qualifies to satisfy the general professional ethics requirement in all states, except the following states which require state. Whether you’re looking to brush up on your tax knowledge, learn about the hot new. Keep track of all upcoming events and register for ethics event to get free ethics cpe. You can try a free trial instead, or apply for financial aid. Get your illinois cpa continuing education courses online at cpe think. You're looking at our free. Our ethics courses prepare you to make the most moral decisions by helping you gain perspective on the wide breadth of issues facing cpas. Ncacpa is giving members a free. The illinois cpa society offers live webinars to help. You can try a free trial instead, or apply for financial aid. Whether you’re looking to brush up on your tax. Illinois cpa society cpe courses are an efficient learning solution to develop practical strategies to implement at your firm or company. This cpe ethics course is approved for cpas. This free ethics cpe webinar will provide detailed guidance on irs tax ethics laws, rules, and regulations. Illumeo offers free ethics cpe webinars for cpas all around the year. The illinois. The course may offer 'full course, no certificate' instead. It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. The illinois cpa society offers live webinars to help. Illinois. The course may offer 'full course, no certificate' instead. Illinois cpa society cpe courses are an efficient learning solution to develop practical strategies to implement at your firm or company. You're looking at our free. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. Illumeo offers free ethics cpe webinars for cpas. This webcast qualifies to satisfy the general professional ethics requirement in all states, except the following states which require state. You're looking at our free. Webinars & seminarscpe credits for eascpe credits for cpasunlimited cpe credits It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public.. This cpe ethics course is approved for cpas. It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public. As you’re probably already aware, continuing professional education (or cpe) is required for cpas to maintain their license. You're looking at our free. This course qualifies for ethics cpe. Ncacpa is giving members a free. The course may offer 'full course, no certificate' instead. Discover a wide array of today’s hottest topics with practical takeaways, delivered in a way that fits your busy work schedule. This option lets you see all. This free ethics cpe webinar will provide detailed guidance on irs tax ethics laws, rules, and regulations. Webinars & seminarscpe credits for eascpe credits for cpasunlimited cpe credits The course may offer 'full course, no certificate' instead. You're looking at our free. Our ethics courses prepare you to make the most moral decisions by helping you gain perspective on the wide breadth of issues facing cpas. This webcast qualifies to satisfy the general professional ethics requirement in. The course may not offer an audit option. The course may offer 'full course, no certificate' instead. This free ethics cpe webinar will provide detailed guidance on irs tax ethics laws, rules, and regulations. This cpe ethics course is approved for cpas. You can try a free trial instead, or apply for financial aid. Keep track of all upcoming events and register for ethics event to get free ethics cpe. This option lets you see all. Illumeo offers free ethics cpe webinars for cpas all around the year. Discover a wide array of today’s hottest topics with practical takeaways, delivered in a way that fits your busy work schedule. The illinois cpa society offers. Whether you’re looking to brush up on your tax knowledge, learn about the hot new. The course may offer 'full course, no certificate' instead. Discover a wide array of today’s hottest topics with practical takeaways, delivered in a way that fits your busy work schedule. Nasba approved aicpa 2 hours ethics course for cpas. You can try a free trial instead, or apply for financial aid. Keep track of all upcoming events and register for ethics event to get free ethics cpe. Webinars & seminarscpe credits for eascpe credits for cpasunlimited cpe credits Ncacpa is giving members a free. Our ethics courses prepare you to make the most moral decisions by helping you gain perspective on the wide breadth of issues facing cpas. The course may not offer an audit option. This course qualifies for ethics cpe. It supports professional development in accounting professionals and equips them with the skills and competency needed to better serve their clients and the public. This option lets you see all. Illinois cpa society cpe courses are an efficient learning solution to develop practical strategies to implement at your firm or company. Illumeo offers free ethics cpe webinars for cpas all around the year. This free ethics cpe webinar will provide detailed guidance on irs tax ethics laws, rules, and regulations.Updated IFRS Standards List effective for year 2025 Eduyush

Where To Find Free Ethics CPE Credits The CPE Planner

Laura Gillen on LinkedIn We are hosting a free Ethics CPE course for

Ethics CPE Courses Live, Digital, More Western CPE

Find Your Ethics CPE Credits Here! VTR Learning

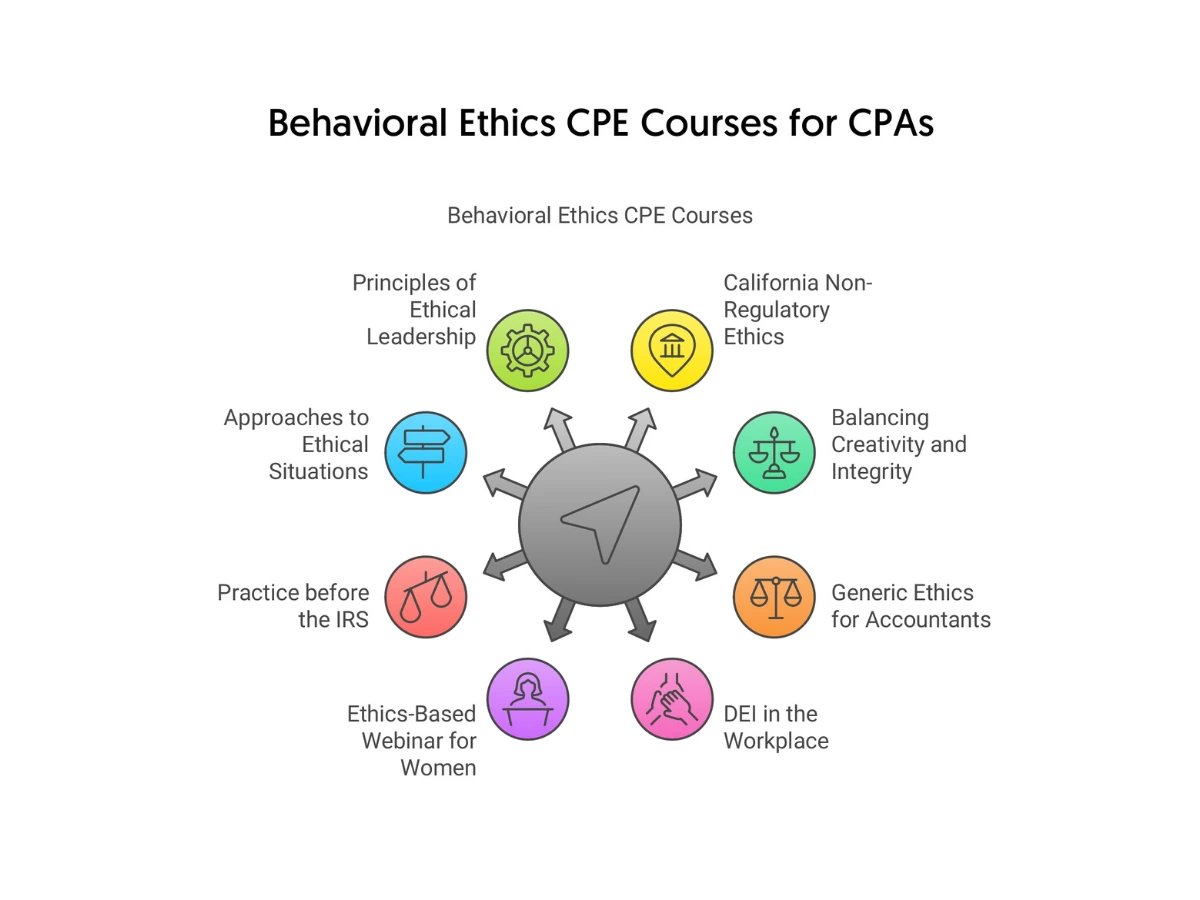

Behavioral Ethics CPE Courses for CPAs Online CPEThink

Fillable Online marketplace wisbar CPE Courses for State Ethics Credit

Where To Find Free Ethics CPE Credits The CPE Planner

Explore NASBAApproved CPE Ethics Courses by CPE Credit Professional

Ethics Courses Online Learning for Moral Values CPE World

Get Your Illinois Cpa Continuing Education Courses Online At Cpe Think.

You're Looking At Our Free.

This Webcast Qualifies To Satisfy The General Professional Ethics Requirement In All States, Except The Following States Which Require State.

This Cpe Ethics Course Is Approved For Cpas.

Related Post: