Golf Course Greens Fees Sales Tax In Michigan

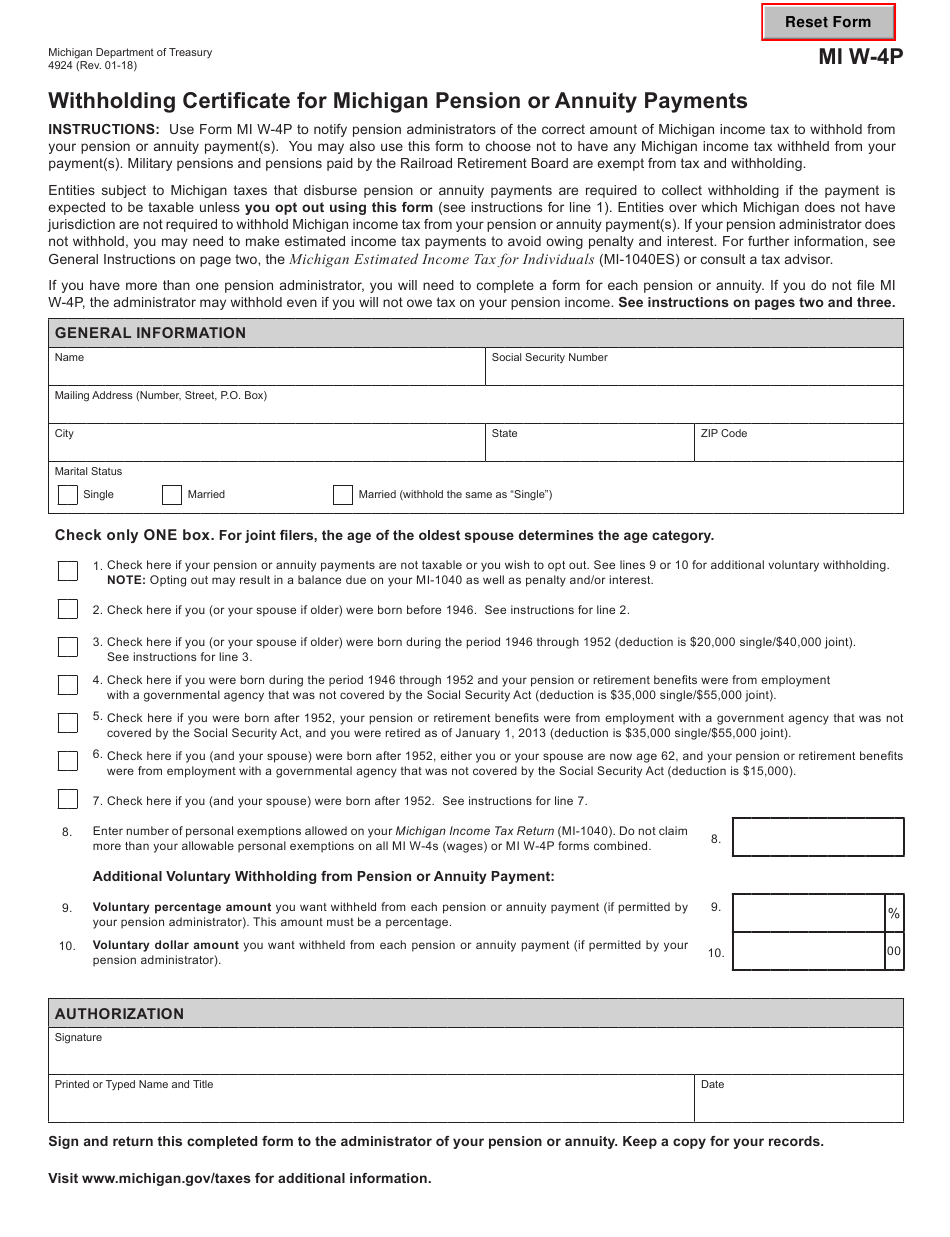

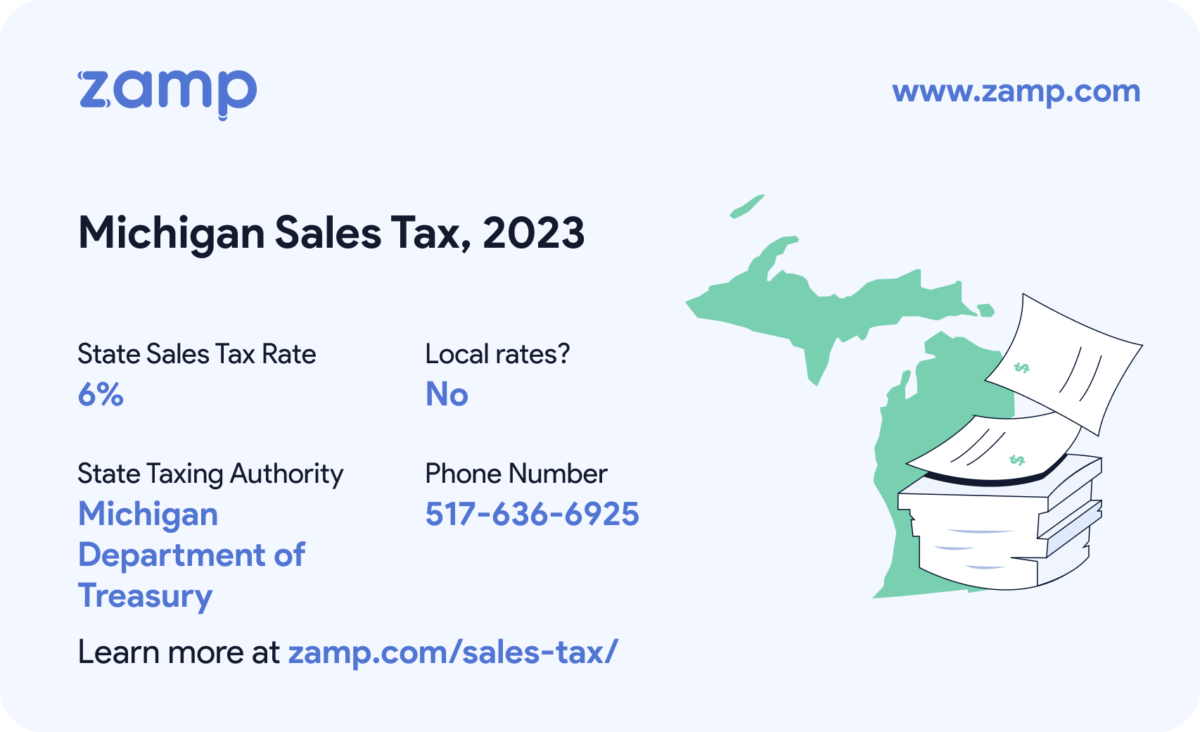

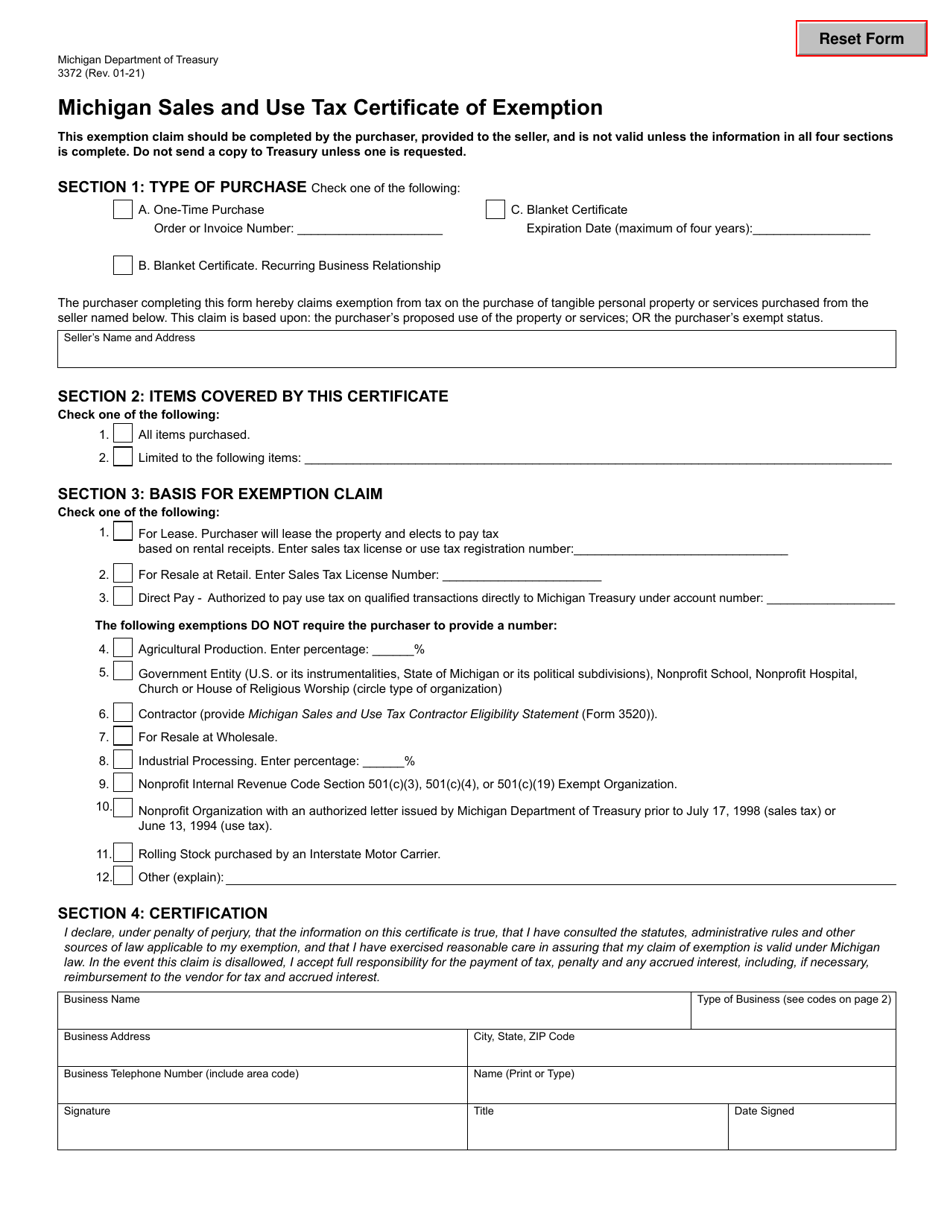

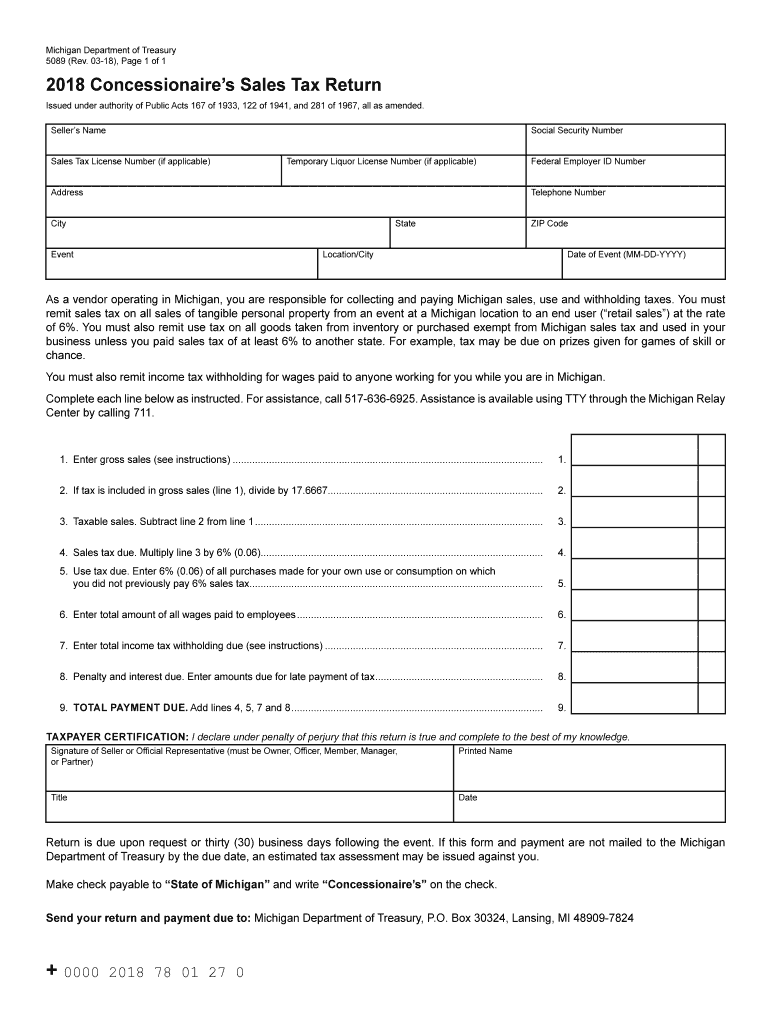

Golf Course Greens Fees Sales Tax In Michigan - How come greens fees are taxed at golf courses? The michigan sales tax handbook provides everything you need to understand the michigan sales tax as a consumer or business owner, including sales tax rates, sales tax exemptions,. The mi sales tax rate is 6%. Golf is more than just an enjoyable pastime in michigan, it is a key industry contributing to the overall economy and quality of life in the great lakes state. The price charged for seniors averages $25; Government services in michigan are generally exempt from sales tax, aligning with the principle of intergovernmental tax immunity. Save time and money on your golf. Michigan imposes a state sales tax and does not allow cities or localities to impose local sales taxes so there are no local sales tax rates in mi. This article explores michigan’s sales and use tax. Are greens fees subject to sales tax in your state? According to mcl 205.54a, sales to the. Save time and money on your golf. How come greens fees are taxed at golf courses? Michigan imposes a state sales tax and does not allow cities or localities to impose local sales taxes so there are no local sales tax rates in mi. Are greens fees subject to sales tax in your state? Book green fees and tee times in real time and get your confirmations immediately. The mi sales tax rate is 6%. The michigan sales tax handbook provides everything you need to understand the michigan sales tax as a consumer or business owner, including sales tax rates, sales tax exemptions,. We offer a choice of over 79 golfcourses spread out thru michigan. Government services in michigan are generally exempt from sales tax, aligning with the principle of intergovernmental tax immunity. Are greens fees subject to sales tax in your state? Government services in michigan are generally exempt from sales tax, aligning with the principle of intergovernmental tax immunity. Most states don't charge sales tax for services. Regular golf is $45 during. Implementing a good point of sale system with services and products properly. Understanding michigan’s tax requirements can be challenging due to varying rates, exemptions, and filing procedures. Sales tax individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the state of. How come greens fees are taxed at golf courses? Most. This article explores michigan’s sales and use tax. The greens fees are subject to sales tax, while the cart rental fees could be exempt from sales tax. According to mcl 205.54a, sales to the. How come greens fees are taxed at golf courses? Michigan’s sales tax rate is 6%, a uniform rate that applies to all taxable sales of tangible. Most states don't charge sales tax for services. Golf is more than just an enjoyable pastime in michigan, it is a key industry contributing to the overall economy and quality of life in the great lakes state. How come greens fees are taxed at golf courses? Are greens fees subject to sales tax in your state? We offer a choice. Our comprehensive guide can help you understand michigan’s sales tax rates, schedules, and penalties, how to file and pay sales taxes to the state government, and what to expect in a. The mi sales tax rate is 6%. I wouldn't call a round of golf a tangible product like a dozen golf balls etc. Government services in michigan are generally. We offer a choice of over 79 golfcourses spread out thru michigan. I cannot recall being charged sales tax on any greens or cart fees in ohio. Save time and money on your golf. The price charged for seniors averages $25; Most states don't charge sales tax for services. The price charged for seniors averages $25; Sales tax compliance in michigan is crucial for businesses to avoid financial penalties and maintain good standing with state taxation authorities. How come greens fees are taxed at golf courses? Michigan’s sales tax rate is 6%, a uniform rate that applies to all taxable sales of tangible personal property as outlined by the. Implementing a good point of sale system with services and products properly. Understanding michigan’s tax requirements can be challenging due to varying rates, exemptions, and filing procedures. How come greens fees are taxed at golf courses? Sales tax individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the. This page answers common questions about which common fees are included in the. I wouldn't call a round of golf a tangible product like a dozen golf balls etc. Most states don't charge sales tax for services. How come greens fees are taxed at golf courses? Are greens fees subject to sales tax in your state? Sales tax individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the state of. This article explores michigan’s sales and use tax. Golf is more than just an enjoyable pastime in michigan, it is a key industry contributing to. Are greens fees subject to sales tax in your state? This page answers common questions about which common fees are included in the. We offer a choice of over 79 golfcourses spread out thru michigan. Implementing a good point of sale system with services and products properly. Michigan’s sales tax rate is 6%, a uniform rate that applies to all taxable sales of tangible personal property as outlined by the general sales tax act, act 167 of 1933. The taxable basis refers to the portion of an entire transaction that is subject to michigan's sales tax. This article explores michigan’s sales and use tax. I wouldn't call a round of golf a tangible product like a dozen golf balls etc. The mi sales tax rate is 6%. According to mcl 205.54a, sales to the. Government services in michigan are generally exempt from sales tax, aligning with the principle of intergovernmental tax immunity. The michigan sales tax handbook provides everything you need to understand the michigan sales tax as a consumer or business owner, including sales tax rates, sales tax exemptions,. Our comprehensive guide can help you understand michigan’s sales tax rates, schedules, and penalties, how to file and pay sales taxes to the state government, and what to expect in a. The price charged for seniors averages $25; The greens fees are subject to sales tax, while the cart rental fees could be exempt from sales tax. Golf is more than just an enjoyable pastime in michigan, it is a key industry contributing to the overall economy and quality of life in the great lakes state.Michigan Sales Tax Form 2025 Enrica Anastasie

Ultimate Michigan Sales Tax Guide Zamp

Michigan Sales Tax Guide for Businesses

Michigan Sales Use And Withholding Tax Form 5081

US Michigan Sales and Use Tax Guide Rates, Nexus & Compliance

Form 3372 Fill Out, Sign Online and Download Fillable PDF, Michigan

Michigan Sales Tax 20182025 Form Fill Out and Sign Printable PDF

Michigan Sales Tax Calculator and Local Rates 2021 Wise

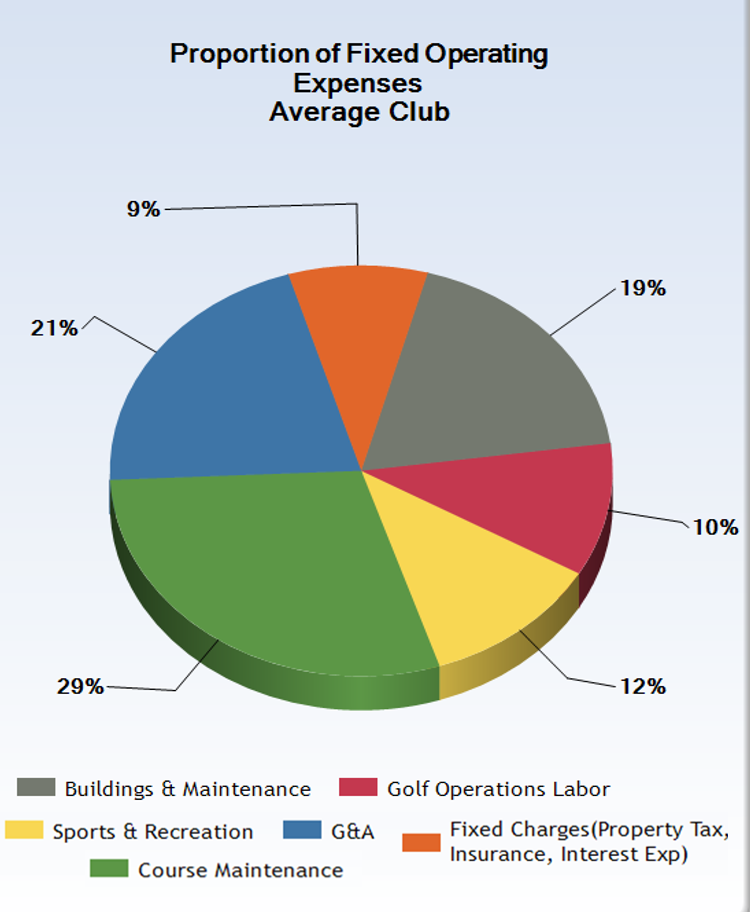

Golf Course MaintenanceHow Much Should You Spend?

Thousand Oaks Golf Club, Grand Rapids, MI Albrecht Golf Guide

Michigan Imposes A State Sales Tax And Does Not Allow Cities Or Localities To Impose Local Sales Taxes So There Are No Local Sales Tax Rates In Mi.

Understanding Michigan’s Tax Requirements Can Be Challenging Due To Varying Rates, Exemptions, And Filing Procedures.

Save Time And Money On Your Golf.

I Cannot Recall Being Charged Sales Tax On Any Greens Or Cart Fees In Ohio.

Related Post: