Requirements For Accounting Course

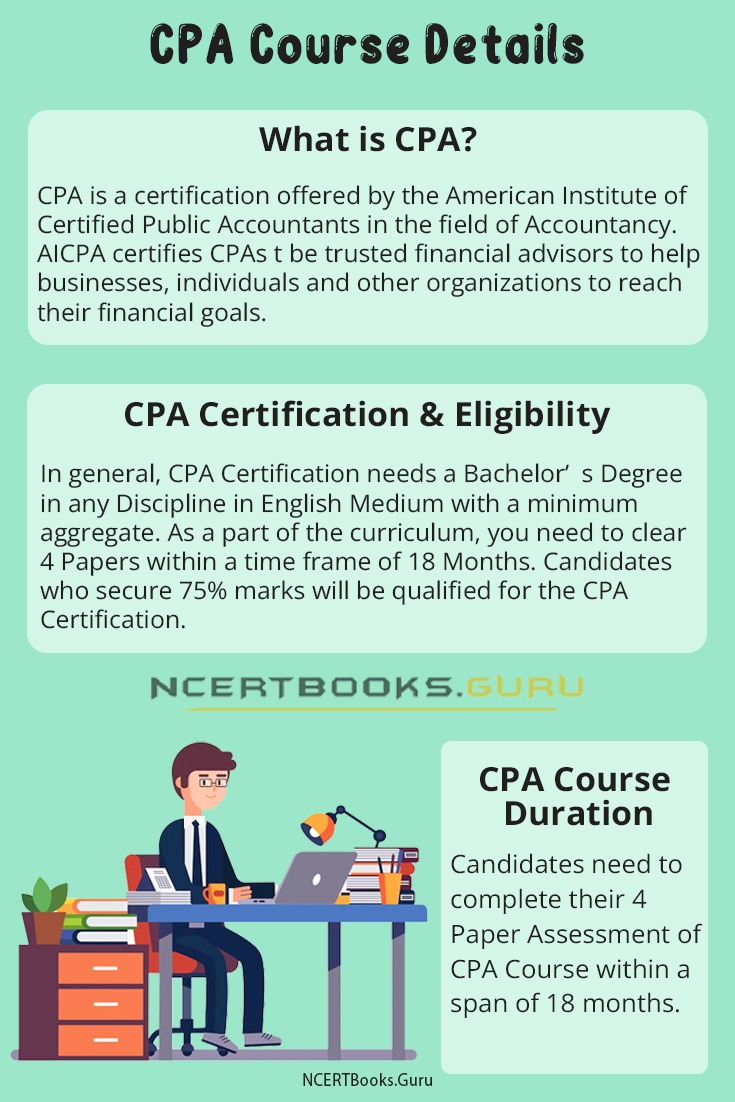

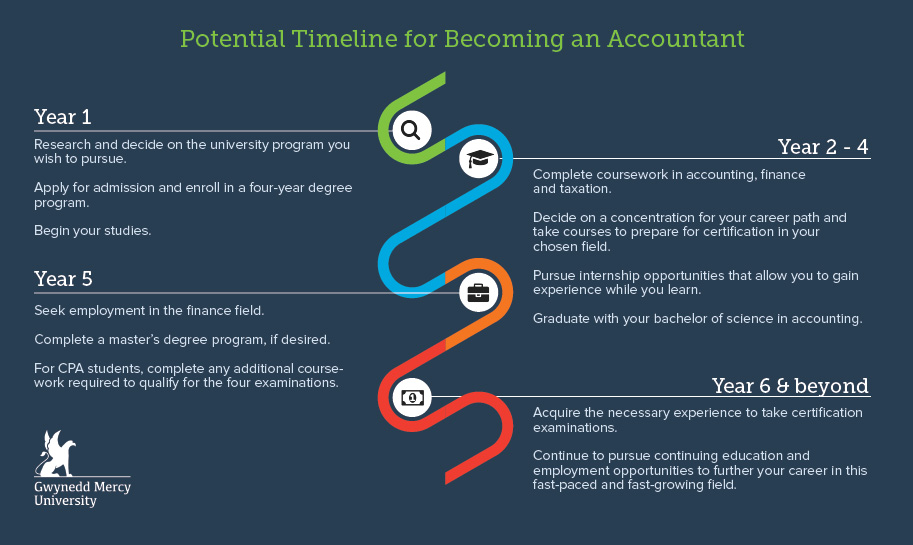

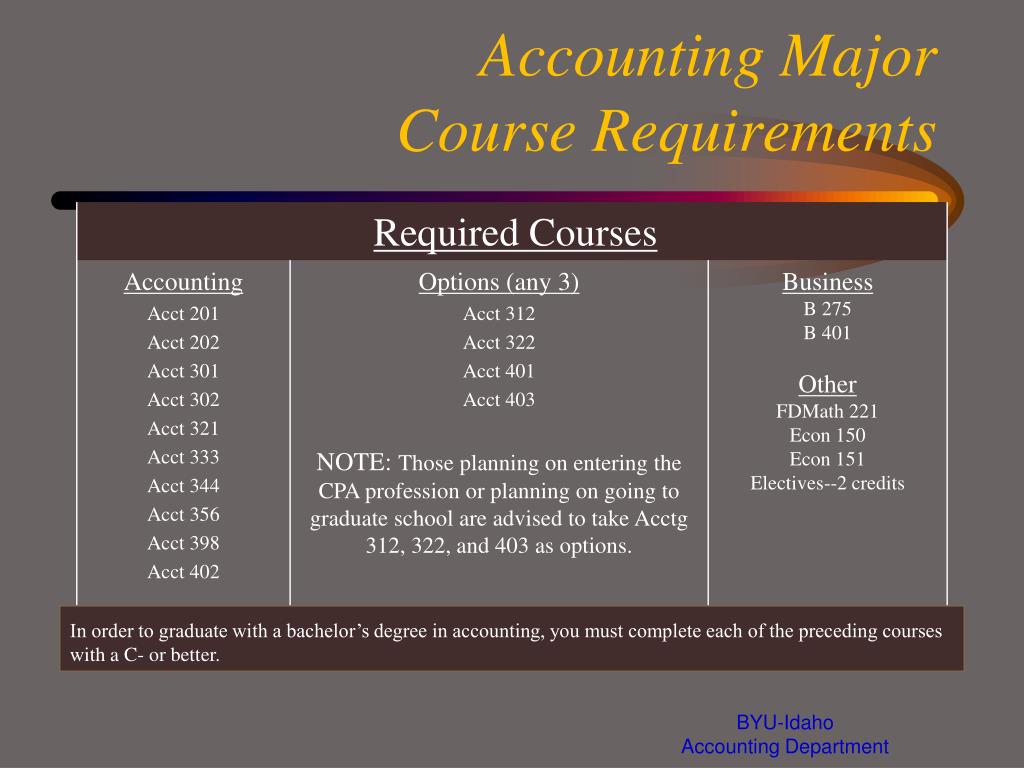

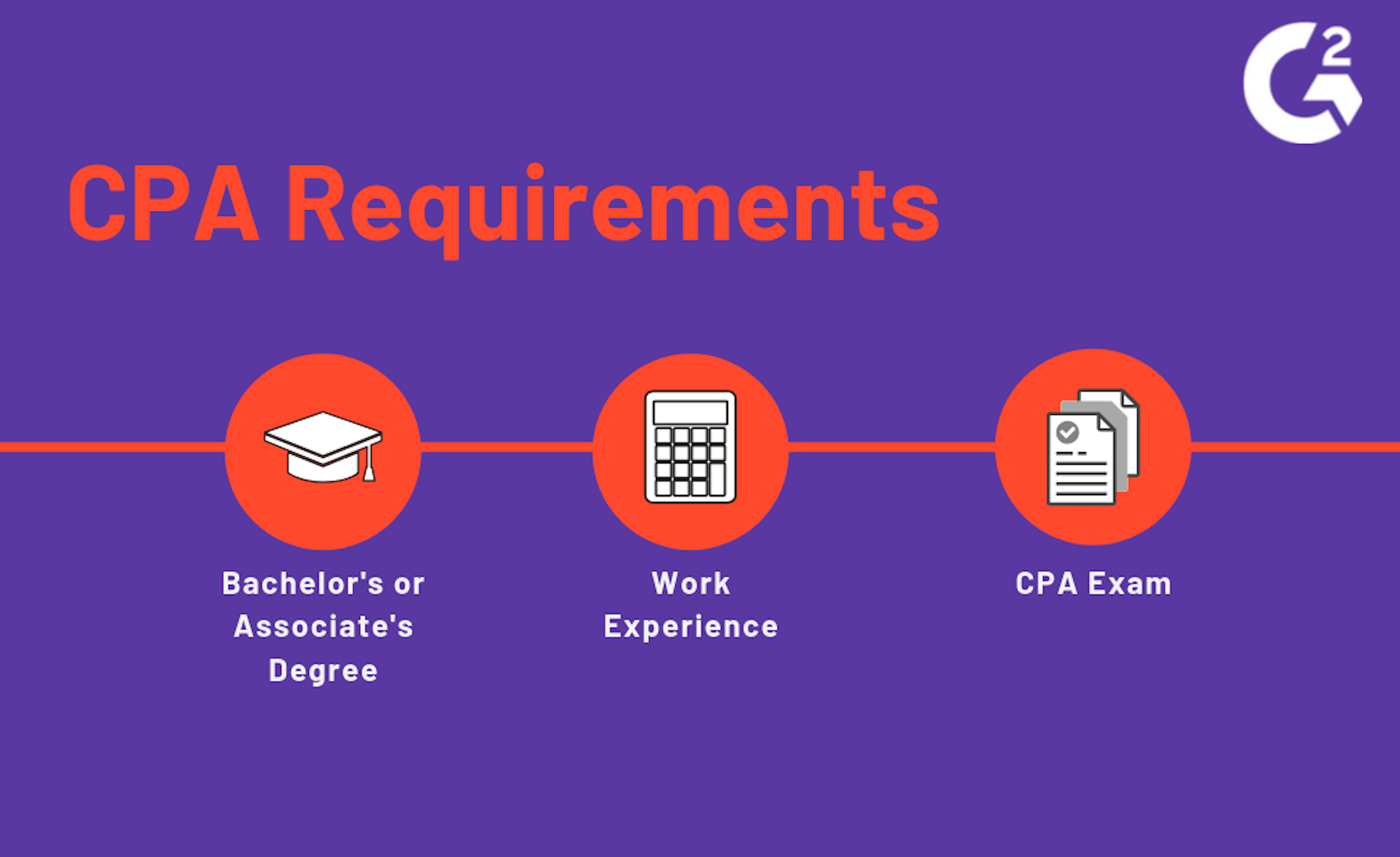

Requirements For Accounting Course - Students planning to major in accounting must be accepted into the college of business.admission requirements to the college of business require completion of 9 lower. Academic advising · graduate studies · online programs · degrees & programs Most states require cpa students to complete a minimum of 150 semester hours of college education. Some general education requirements are fulfilled via coursework that is part of the bs accounting major requirements. The 150 credit hour rule. With this practical degree, you can pursue a variety of accounting and finance jobs or advance to a master’s program. The master of science in accounting analytics (msaa) program in the manning school. A bachelor’s degree in accountingis often the first benchmark toward a career in business, finance, or different types of accounting. A bachelor’s in accounting is also the first step toward the. Accountants are typically required to have a bachelor’s degree in accounting or a related field, like finance. Some general education requirements are fulfilled via coursework that is part of the bs accounting major requirements. For aspiring cpas, understanding these requirements is the first step toward achieving their goal. The master of science in accounting analytics (msaa) program in the manning school. Academic advising · graduate studies · online programs · degrees & programs Students planning to major in accounting must be accepted into the college of business.admission requirements to the college of business require completion of 9 lower. High demand specialtieslearn valuable skillsfurther your educationtransfer friendly Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. This guide provides a detailed overview of the education, examination, experience, and. Of note, bs accounting students must take two writing. The 150 credit hour rule. Between the application fees and review courses, the cost can reach $4,000 or more depending on your state and how many times you take the exam. The 150 credit hour rule. Becoming a cpa starts with a bachelor’s degree, often in accounting. The master of science in accounting analytics (msaa) program in the manning school. Many programs have general education. With this practical degree, you can pursue a variety of accounting and finance jobs or advance to a master’s program. Of note, bs accounting students must take two writing. Each state’s board of accountancy along with the state’s legislature will determine the state’s education requirements 1) for taking the cpa exam, 2) for becoming a licensed cpa, and 3). Academic. Becoming a licensed certified public accountant (cpa) involves acquiring a combination of education, work experience, and passing examination scores. For aspiring cpas, understanding these requirements is the first step toward achieving their goal. In this article, we will discuss the typical classes required for an accounting degree, including the core courses, electives, and any additional requirements for certification. Most states. Each state’s board of accountancy along with the state’s legislature will determine the state’s education requirements 1) for taking the cpa exam, 2) for becoming a licensed cpa, and 3). Accountants are typically required to have a bachelor’s degree in accounting or a related field, like finance. With this practical degree, you can pursue a variety of accounting and finance. High demand specialtieslearn valuable skillsfurther your educationtransfer friendly Therefore, you should still expect to take an english composition i and. Accredited programsaccelerated programsone course per month Academic advising · graduate studies · online programs · degrees & programs This degree program covers basic accounting concepts such as generally accepted accounting principles (gaap), spreadsheets, financial and managerial accounting, tax and. Between the application fees and review courses, the cost can reach $4,000 or more depending on your state and how many times you take the exam. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. Of note, bs accounting students must take two writing. Therefore, you should still expect to take an. The lynn pippenger school of accountancy has additional admission requirements beyond the entry requirements to the muma college of business. This guide provides a detailed overview of the education, examination, experience, and. The master of science in accounting analytics (msaa) program in the manning school. In this article, we will discuss the typical classes required for an accounting degree, including. The accounting major offers a broad program of accounting courses, which coupled with required and elective courses in economics and business administration, provides the graduate with a. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. With this practical degree, you can pursue a variety of accounting and finance jobs or advance. High demand specialtieslearn valuable skillsfurther your educationtransfer friendly Therefore, you should still expect to take an english composition i and. The lynn pippenger school of accountancy has additional admission requirements beyond the entry requirements to the muma college of business. A bachelor’s degree in accountingis often the first benchmark toward a career in business, finance, or different types of accounting.. With this practical degree, you can pursue a variety of accounting and finance jobs or advance to a master’s program. Becoming a cpa starts with a bachelor’s degree, often in accounting. Accountants are typically required to have a bachelor’s degree in accounting or a related field, like finance. Between the application fees and review courses, the cost can reach $4,000. This degree program covers basic accounting concepts such as generally accepted accounting principles (gaap), spreadsheets, financial and managerial accounting, tax and. High demand specialtieslearn valuable skillsfurther your educationtransfer friendly The core accounting classes in most bachelors’s programs typically include basic, intermediate and advanced. Some general education requirements are fulfilled via coursework that is part of the bs accounting major requirements. Accredited programsaccelerated programsone course per month Becoming a cpa starts with a bachelor’s degree, often in accounting. Students planning to major in accounting must be accepted into the college of business.admission requirements to the college of business require completion of 9 lower. Each state’s board of accountancy along with the state’s legislature will determine the state’s education requirements 1) for taking the cpa exam, 2) for becoming a licensed cpa, and 3). Most states require cpa students to complete a minimum of 150 semester hours of college education. The lynn pippenger school of accountancy has additional admission requirements beyond the entry requirements to the muma college of business. Most states require cpa candidates to complete 150 semester hours of college education at an accredited college. With this practical degree, you can pursue a variety of accounting and finance jobs or advance to a master’s program. The accounting major offers a broad program of accounting courses, which coupled with required and elective courses in economics and business administration, provides the graduate with a. A bachelor’s in accounting is also the first step toward the. Typically, bachelor’s degrees account for around 120 credit hours, meaning that. Between the application fees and review courses, the cost can reach $4,000 or more depending on your state and how many times you take the exam.Tips About How To A Certified Accountant

How to an Accountant Learn the Steps, Degrees & Requirements

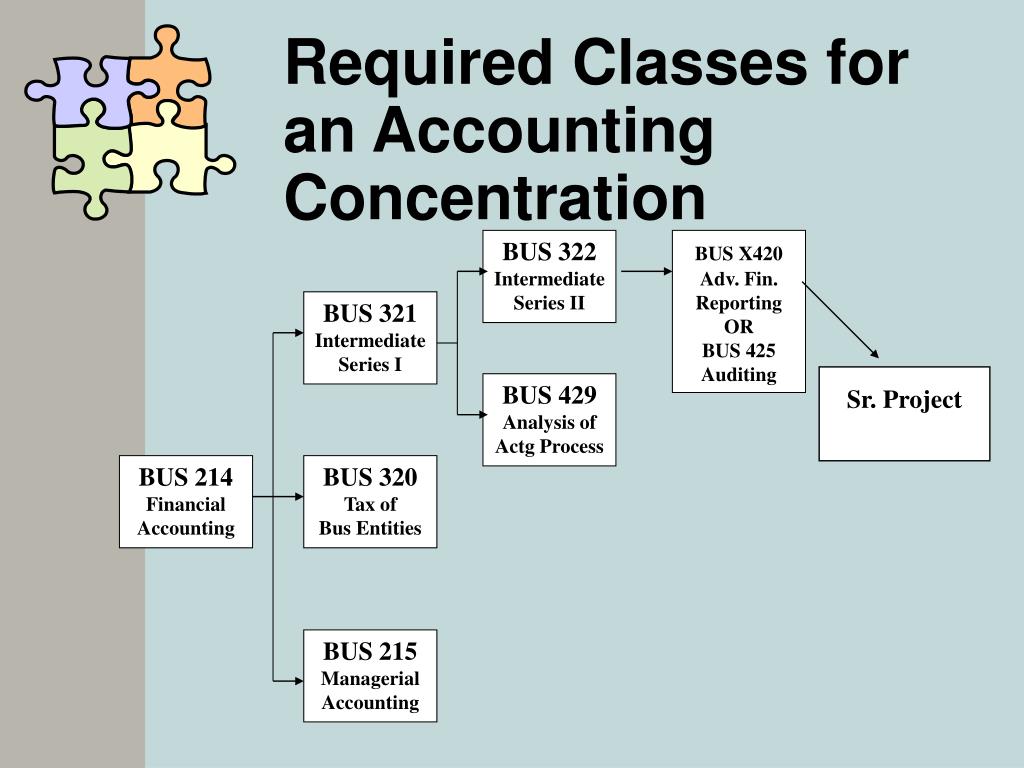

PPT Accounting PowerPoint Presentation, free download ID1033017

New York CPA Exam Requirements 2025 10 Critical Steps SuperfastCPA

Examining the Ethics Education Requirements for CPA Candidates The

3 CPA Requirements for the Aspiring Public Accountant

CPA Exam Requirements (By State) The Big 4 Accounting Firms

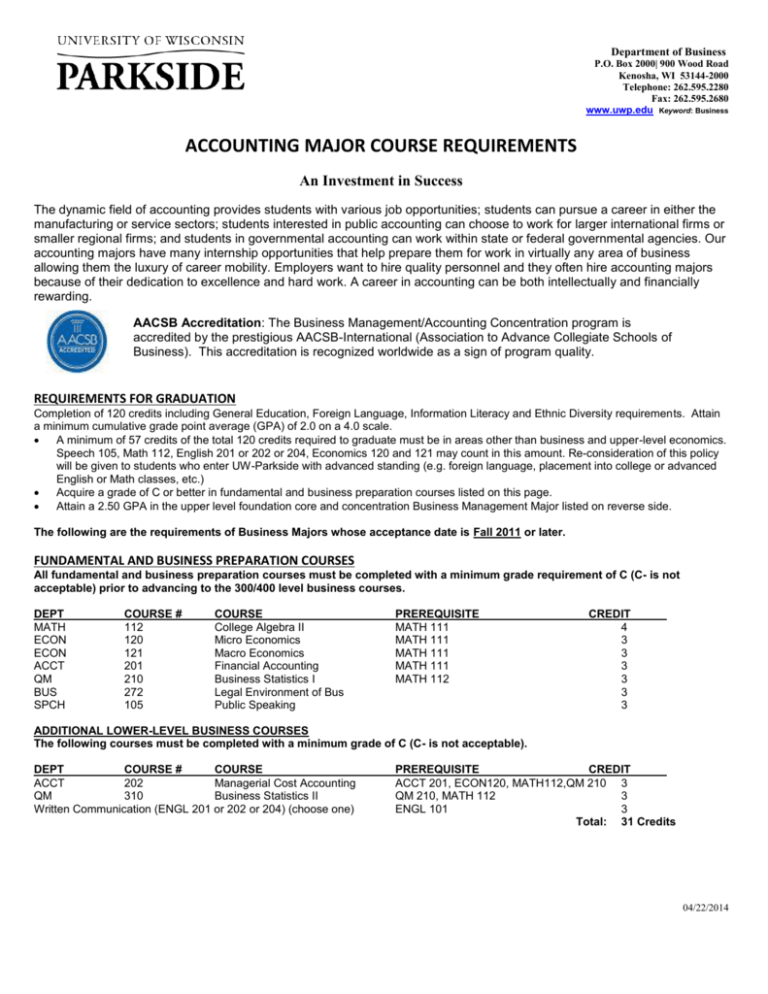

ACCOUNTING MAJOR COURSE REQUIREMENTS

PPT Your Career Goals. . . PowerPoint Presentation, free download

Required Courses For Accounting PDF Accounting Audit

Specific Accounting Degree Requirements Will Vary By The Employer.

Many Programs Have General Education Requirements That All Students Must Fulfill, And Accounting Is No Exception.

In This Article, We Will Discuss The Typical Classes Required For An Accounting Degree, Including The Core Courses, Electives, And Any Additional Requirements For Certification.

The Certificate Program Consists Of 15 Credit Hours In Accounting;

Related Post: