Tax Lien Courses

Tax Lien Courses - Discover the benefits of tax lien investing with the u.s. Tax lien certificate school is a comprehensive tax lien investing course designed. We also discuss how to use tax. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Build a base of knowledge. From understanding the fundamental concepts to exploring the intricate nuances, the curriculum. By the end of these video training series, you should be comfortable with the fundamentals of tax lien and deed investing. Equip yourself with a thorough understanding of tax lien investing through our comprehensive learning modules. This course is fully delivered online. Achieve your financial goals through tax lien certificate and tax deed property investing. Whether through our annual fall tax school in november and december or. Learn how to invest in tax liens, understand the potential returns, and access expert resources to guide your. By the end of these video training series, you should be comfortable with the fundamentals of tax lien and deed investing. Build a base of knowledge. Each module includes three to five brief, precise. From a basic overview of the tax sale lifecycle to more complex topics like due diligence and roi. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits This course is fully delivered online. Learn the secrets of tax lien investing today! Free tax lien investing course by us tax lien association. From understanding the fundamental concepts to exploring the intricate nuances, the curriculum. Equip yourself with a thorough understanding of tax lien investing through our comprehensive learning modules. We also discuss how to use tax. In this article, we’ll take a look at some of the best tax lien investing courses available. By the end of these video training series, you. Learn how to invest in tax liens, understand the potential returns, and access expert resources to guide your. Build a base of knowledge. We also discuss how to use tax. Ignite your path to financial freedom today through the power of investing in tax liens. Each module includes three to five brief, precise. In this article, we'll walk you through how the process works as well as help you in choosing the best tax lien investing course for you so you can get started on your real estate investment. Equip yourself with a thorough understanding of tax lien investing through our comprehensive learning modules. We also discuss how to use tax. Can't find. Free tax lien investing course by us tax lien association. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits From understanding the fundamental concepts to exploring the intricate nuances, the curriculum. Learn the secrets of tax lien investing today! Each module includes three to five brief, precise. Learn about tax lien investing with confidence from america’s trusted educator. From understanding the fundamental concepts to exploring the intricate nuances, the curriculum. Learn the secrets of tax lien investing today! Learn how to invest in tax liens, understand the potential returns, and access expert resources to guide your. Free tax lien investing course by us tax lien association. Build a base of knowledge. Learn the secrets of tax lien investing today! Tax lien certificate school is a comprehensive tax lien investing course designed. From understanding the fundamental concepts to exploring the intricate nuances, the curriculum. Whether through our annual fall tax school in november and december or. Each module includes three to five brief, precise. Tax lien certificate school is a comprehensive tax lien investing course designed. Learn how to invest in tax liens, understand the potential returns, and access expert resources to guide your. 6 module online intro course. We also discuss how to use tax. We also discuss how to use tax. Free tax lien investing course by us tax lien association. Learn how to invest in tax liens, understand the potential returns, and access expert resources to guide your. Build a base of knowledge. Can't find the course you. Free tax lien investing course by us tax lien association. Ignite your path to financial freedom today through the power of investing in tax liens. Can't find the course you. You must pass the exam at 100% in order to move. Discover the benefits of tax lien investing with the u.s. Trainup.com currently lists virtual tax courses and training in and nearby the chicago region from 1 of the industry's leading training providers, such as nbi, inc. Each module includes three to five brief, precise. Can't find the course you. Discover the benefits of tax lien investing with the u.s. In this article, we’ll take a look at some of the. After each video module there is an exam. In this article, we’ll take a look at some of the best tax lien investing courses available. Whether through our annual fall tax school in november and december or. Achieve your financial goals through tax lien certificate and tax deed property investing. Learn the secrets of tax lien investing today! From a basic overview of the tax sale lifecycle to more complex topics like due diligence and roi. In this article, we'll walk you through how the process works as well as help you in choosing the best tax lien investing course for you so you can get started on your real estate investment. Free tax lien investing course by us tax lien association. This course is fully delivered online. Equip yourself with a thorough understanding of tax lien investing through our comprehensive learning modules. Learn about tax lien investing with confidence from america’s trusted educator. We help you start investing in tax deeds and tax liens with as little as $500. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Trainup.com currently lists virtual tax courses and training in and nearby the chicago region from 1 of the industry's leading training providers, such as nbi, inc. By the end of these video training series, you should be comfortable with the fundamentals of tax lien and deed investing. Learn how to invest in tax liens, understand the potential returns, and access expert resources to guide your.Tax Lien Training Special • Be Free University

Tax Lien Certificate Investor's wiki

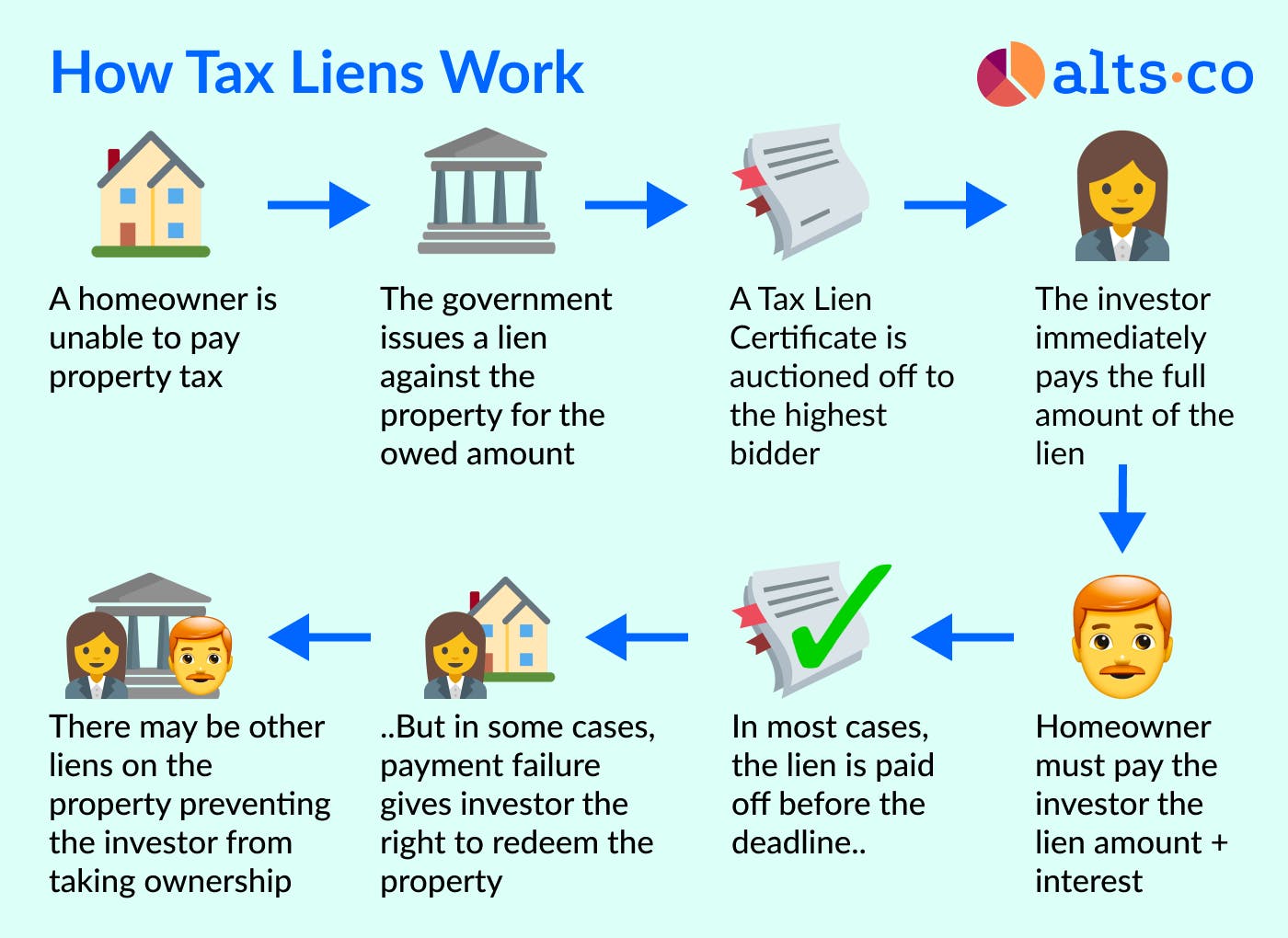

Investing In Tax Liens Alts.co

PPT Things to Know About Tax Lien Certificate and Its Investment

Ted Thomas Tax Lien Certificate and Tax Deed Complete Training System

What is a Tax Lien Certificate? How do they Work Explained! YouTube

Tax Lien Certificate Sales

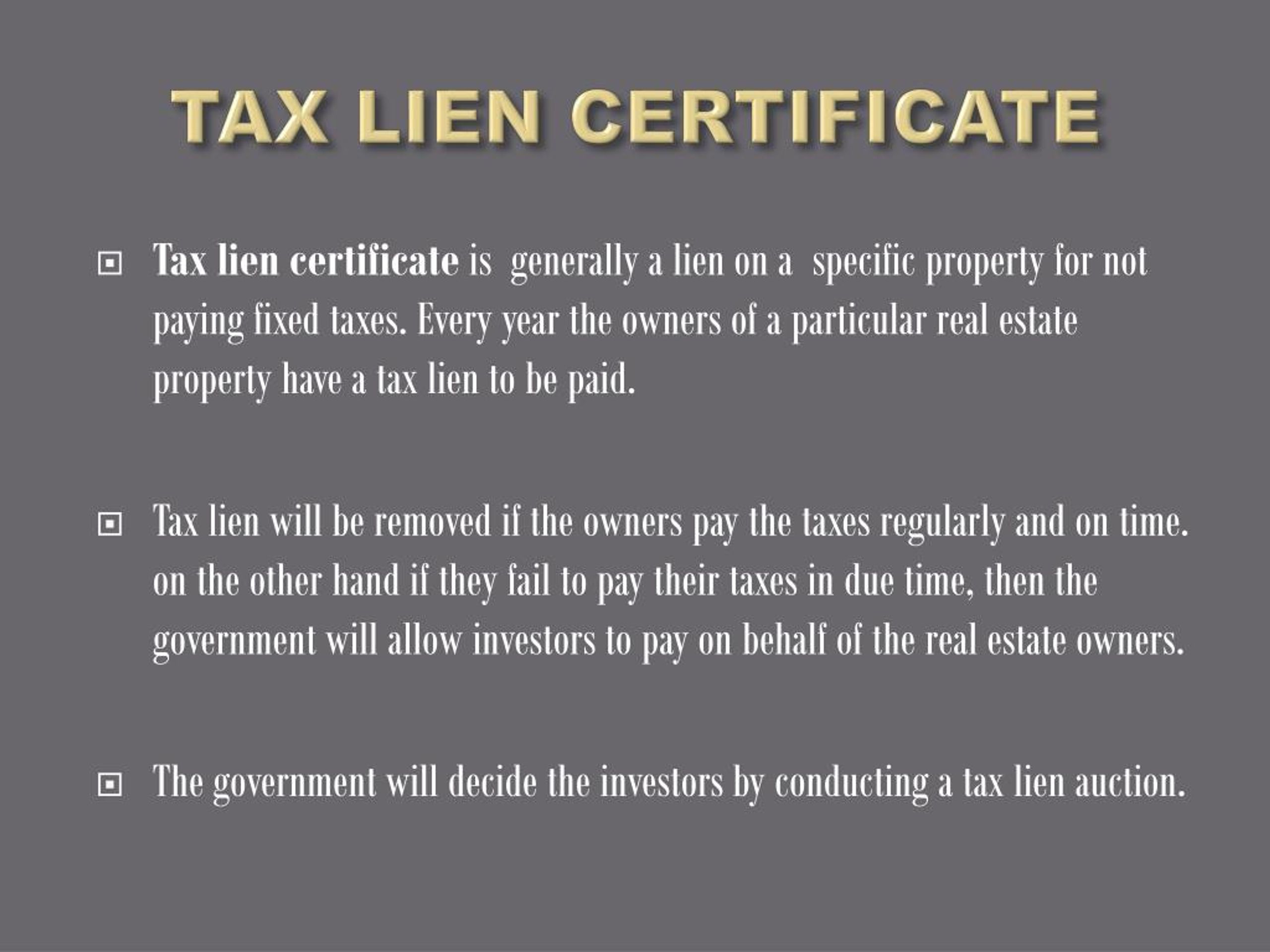

PPT What is Tax Lien Certificate and what is the use of it PowerPoint

What Is a Tax Lien Certificate? How They're Sold in Investing

Tax Liens Certificates Top Investment Strategies That Work

We Also Discuss How To Use Tax.

Discover The Benefits Of Tax Lien Investing With The U.s.

Each Module Includes Three To Five Brief, Precise.

Build A Base Of Knowledge.

Related Post:

:max_bytes(150000):strip_icc()/taxliencertificate.asp-final-b2b6b823202f45b9ab56efc51304ed44.png)