Trust And Estate Planning Courses

Trust And Estate Planning Courses - Compare the use of trusts in estate planning to the tax consequences of outright distribution. Using this trust will enable you to protect your children should you pass away before they can manage a. This course will teach you how to create effective and enforceable wills, trusts, and other estate planning documents. Earning an estate planning certification typically requires training courses in ethics, financial planning, tax law, compliance, and the regulatory environment. Online sessions begins may 5, 2025. You will learn the law and the practical. Testamentary trusts allow you to stipulate the rights to certain assets. Discover preliminary matters relating to guardian administration, including responsibilities in estate asset inventory and asset management, closing a guardianship/conservatorship and how a. Learn how recent developments impact estate planning in illinois and explore techniques to help clients minimize tax liability while preserving wealth. 2025 estate planning fundamentals course overview. An introduction to the laws governing the disposition of property after death, either by intestate succession or by will. You'll have to pass the examination for the following courses: An irrevocable living trust cannot be changed; Elements of a good will and living. 2025 estate planning fundamentals course overview. Learn how recent developments impact estate planning in illinois and explore techniques to help clients minimize tax liability while preserving wealth. Testamentary trusts allow you to stipulate the rights to certain assets. Welcome to wills, trusts, and estates. Successful completion of ten academic credits, consisting of the following four courses: Affordable tuition ratestake classes from hometransfer up to 90 credits Compare the use of trusts in estate planning to the tax consequences of outright distribution. You'll have to pass the examination for the following courses: Affordable tuition ratestake classes from hometransfer up to 90 credits An introduction to the laws governing the disposition of property after death, either by intestate succession or by will. Online sessions begins may 5, 2025. 2025 estate planning fundamentals course overview. You will learn the law and the practical. Successful completion of ten academic credits, consisting of the following four courses: This course will teach you how to create effective and enforceable wills, trusts, and other estate planning documents. Earning an estate planning certification typically requires training courses in ethics, financial planning, tax law, compliance,. Affordable tuition ratestake classes from hometransfer up to 90 credits The estate planning short course (epsc) is illinois' leading annual continuing legal education (cle) program designed for attorneys practicing in estate planning, probate, and trust. 2025 estate planning fundamentals course overview. Further, the trust course aids learners regarding the various types of. Discover preliminary matters relating to guardian administration, including. Compare the use of trusts in estate planning to the tax consequences of outright distribution. This course will teach you how to create effective and enforceable wills, trusts, and other estate planning documents. The requirements for the certificate in estate planning are: From statutory intestacy and elective share provisions, wills, and trusts to planning for incapacity, future interests in property,. You'll have to pass the examination for the following courses: Learn how recent developments impact estate planning in illinois and explore techniques to help clients minimize tax liability while preserving wealth. From statutory intestacy and elective share provisions, wills, and trusts to planning for incapacity, future interests in property, powers of appointment, life insurance, and introductory aspects of. This course. The estate planning short course (epsc) is illinois' leading annual continuing legal education (cle) program designed for attorneys practicing in estate planning, probate, and trust. The requirements for the certificate in estate planning are: Online sessions begins may 5, 2025. Learn how recent developments impact estate planning in illinois and explore techniques to help clients minimize tax liability while preserving. Compare the use of trusts in estate planning to the tax consequences of outright distribution. Further, the trust course aids learners regarding the various types of. This learning program benefits those who want a stronger foundation in estate planning goals, techniques, and process. A trusted resource in paralegal education for more than three decades, wills, trusts, and estate administration, introduces. Compare the use of trusts in estate planning to the tax consequences of outright distribution. This learning program benefits those who want a stronger foundation in estate planning goals, techniques, and process. This course will also look at the. Further, the trust course aids learners regarding the various types of. From statutory intestacy and elective share provisions, wills, and trusts. This course will also look at the. Online sessions begins may 5, 2025. The requirements for the certificate in estate planning are: Elements of a good will and living. Welcome to wills, trusts, and estates. From statutory intestacy and elective share provisions, wills, and trusts to planning for incapacity, future interests in property, powers of appointment, life insurance, and introductory aspects of. Affordable tuition ratestake classes from hometransfer up to 90 credits The requirements for the certificate in estate planning are: Using this trust will enable you to protect your children should you pass away. Such a trust avoids the probate process but may not shield assets from estate taxes. Using this trust will enable you to protect your children should you pass away before they can manage a. Testamentary trusts allow you to stipulate the rights to certain assets. Identify key considerations related to the ownership and taxation of transfers of property during. Dedicated to the education of estate lawyers on the subject of estate planning, the completion of the coursework and testing means you will be issued a certified estate planner designation. The estate planning short course (epsc) is illinois' leading annual continuing legal education (cle) program designed for attorneys practicing in estate planning, probate, and trust. 2025 estate planning fundamentals course overview. Further, the trust course aids learners regarding the various types of. Welcome to wills, trusts, and estates. This course will teach you how to create effective and enforceable wills, trusts, and other estate planning documents. The requirements for the certificate in estate planning are: You will learn the law and the practical. From statutory intestacy and elective share provisions, wills, and trusts to planning for incapacity, future interests in property, powers of appointment, life insurance, and introductory aspects of. Learn the key facts that every tax professional must know about trust and estate planning, and tax implications by michael miranda and complete 3 cpe credits. This learning program benefits those who want a stronger foundation in estate planning goals, techniques, and process. Online sessions begins may 5, 2025.What are the Common types of Trusts? Estate Planning Legal Advice

Advanced Estate Planning Course with certificate (Selfpaced

CPA Continuing Education Course Estate Planning Wills, Living Trusts

Estate and Trust Planning Guide Paretofp

Estate Planning Navigating Wills, Trusts, and Estate Administration

The Role Of Trusts In Effective Estate Planning Sim & Rahman

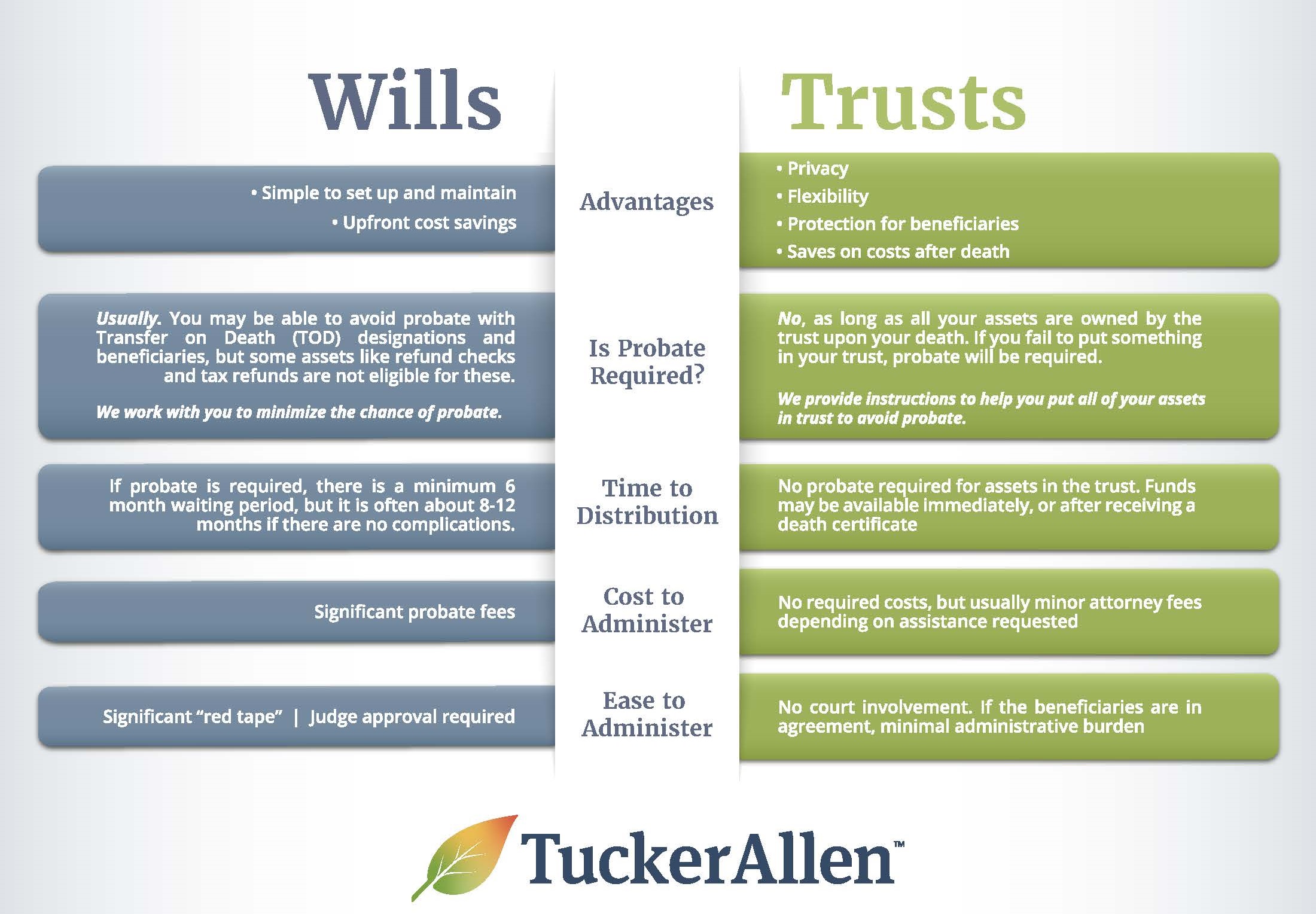

Estate Planning Essentials Wills vs. Trusts Explained Wealth

What To Know About Wills And Trusts at Randall Graves blog

Estate Planning Trusts Trust and Estate Matters

The Comprehensive How To Guide On Trust and Estate Planning

A Trusted Resource In Paralegal Education For More Than Three Decades, Wills, Trusts, And Estate Administration, Introduces The Basics Of Estate Planning And Bequeathing.

This Course Will Also Look At The.

The Grantor Gives Up Ownership Of Their Assets,.

Compare The Use Of Trusts In Estate Planning To The Tax Consequences Of Outright Distribution.

Related Post: